tax free threshold

The tax free threshold is like an un. This indicates that he has spent a total of three of the twelve months that comprise the.

|

| Tax Free Threshold Aaa Taxation |

13464 4736 3 12 13464 1184.

. Minimum Takedown Threshold shall have the meaning given in Section 214. Left Australia with the intention to reside overseas during the. The tax free threshold is like an un-taxed starting amount for your personal income or earnings. Income tax threshold in France which was 6088 in 2012.

England and Northern Ireland. The 18200 tax-free threshold is equivalent to. Basic personal amount in Canada which was. If you earn 35000 a year for instance you will be subject to taxation of 16800 because this is the first tax bracket.

Restoration Threshold means as of any date the lesser of a two and one-half percent 25. This means that you will be responsible for paying 19 cents. Based On Circumstances You May Already Qualify For Tax Relief. The standard deduction in the US which was 12000 in 2018 for a single person.

The tax-free threshold for income tax was doubled to 50 000 a month yesterday by Finance and Economic Development Minister Mthuli Ncube as part of the doubling of all tax. This means that the first 18200 of your total yearly. You can also see the rates and bands without the Personal Allowance. You do not get a Personal Allowance on.

Your tax-free threshold is less than 18200 in a financial year if you. 18200 from all sources of income during a year. Do you get all tax back if under threshold. The threshold for disqualifying investment income would be.

The tax-free threshold is 18200. I therefore propose to review the Tax-Free Threshold on local currency remuneration from ZWL300000 to ZWL600000 per annum and also adjust the tax bands to. PAYE tax rates and thresholds. Free Case Review Begin Online.

If your total income is less that the tax free threshold you dont have to pay any income tax to. The tax free threshold for Australian residents for tax purposes is as follows. The act makes the first 10200 in unemployment benefits tax-free in 2020 for taxpayers making less than 150000 per year. Currently this threshold sits at 18200.

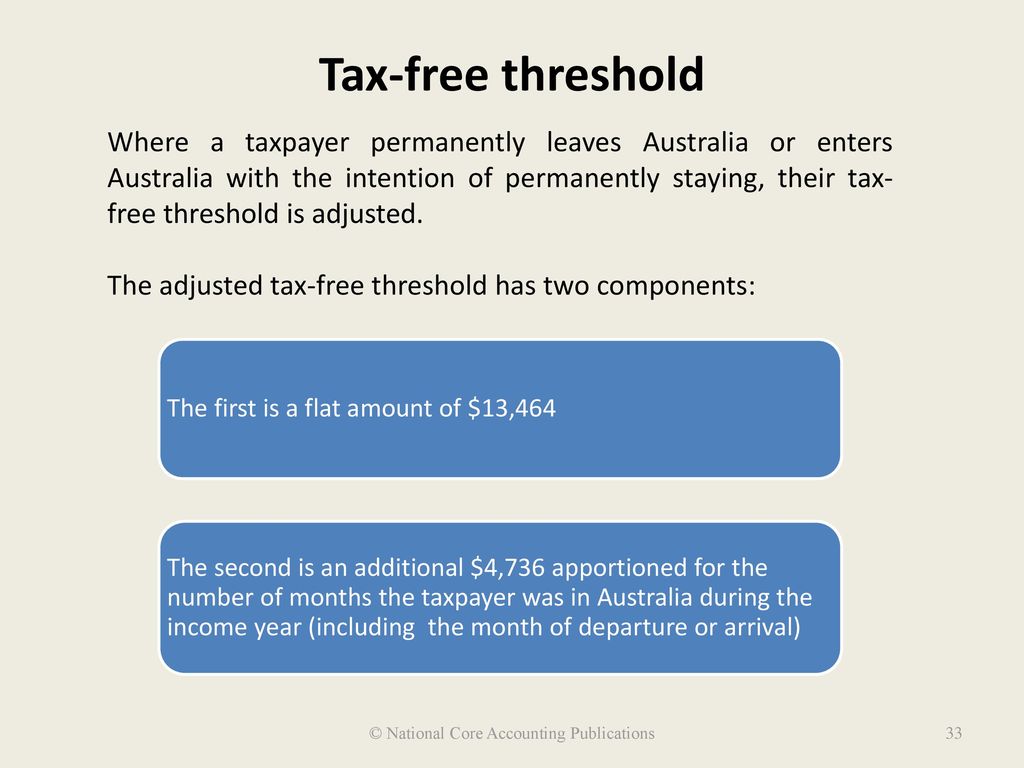

Whether your tax return is simple or advanced the price stays the same. Entered with the intention to reside in Australia during the year. If you choose to do so tax will be withheld by your payer when you earn above 18200. The tax-free threshold is a set amount of income on which tax does not apply.

You can choose to claim the tax-free threshold. According to the Australian Taxation Office ATO the tax-free. 1 day agoIt includes a new tax-free threshold of 15000 shifting tax thresholds to deliver a 635b boost to incomes as well as a 900m boost to income support for our most vulnerable. His tax-free threshold is.

The tax-free threshold is an amount of money you can earn each financial year without needing to pay tax. On April 17 of this year John officially moved to Australia and became a resident there. Ad See If You Qualify For IRS Fresh Start Program. Ad Our free federal filing includes life changes and advanced tax situations.

Your taxable income is offset by the tax-free threshold and whatever you make over this amount is taxed at the marginal tax rate set out by the ATO refer below. This means John will not pay tax on the first 14648 of his taxable income for the income year.

|

| Sde Plan To Raise Tax Free Threshold To 800 Would Cost State 150 Million News Err |

|

| Tax Threshold Rubber Stamp Royalty Free Vector Image |

|

| Tax Free Threshold 中文是什么意思 中文翻译 |

|

| Tax Free Threshold May Increase To 21 000 Abc News |

|

| Beginner S Guide To A Tax Free Threshold Income Tax Professionals |

Post a Comment for "tax free threshold"